There’s finally some breathing room for buyers who’ve been watching from the sidelines.

After a few really tough years, buying a home is starting to feel more within reach. Monthly payments are coming down, and that squeeze we’ve all been talking about? It’s loosening up. Now, I’m not saying everyone can suddenly afford to buy tomorrow, but the fact that things are moving in the right direction matters—especially after how challenging this market has been.

The Numbers Are Shifting

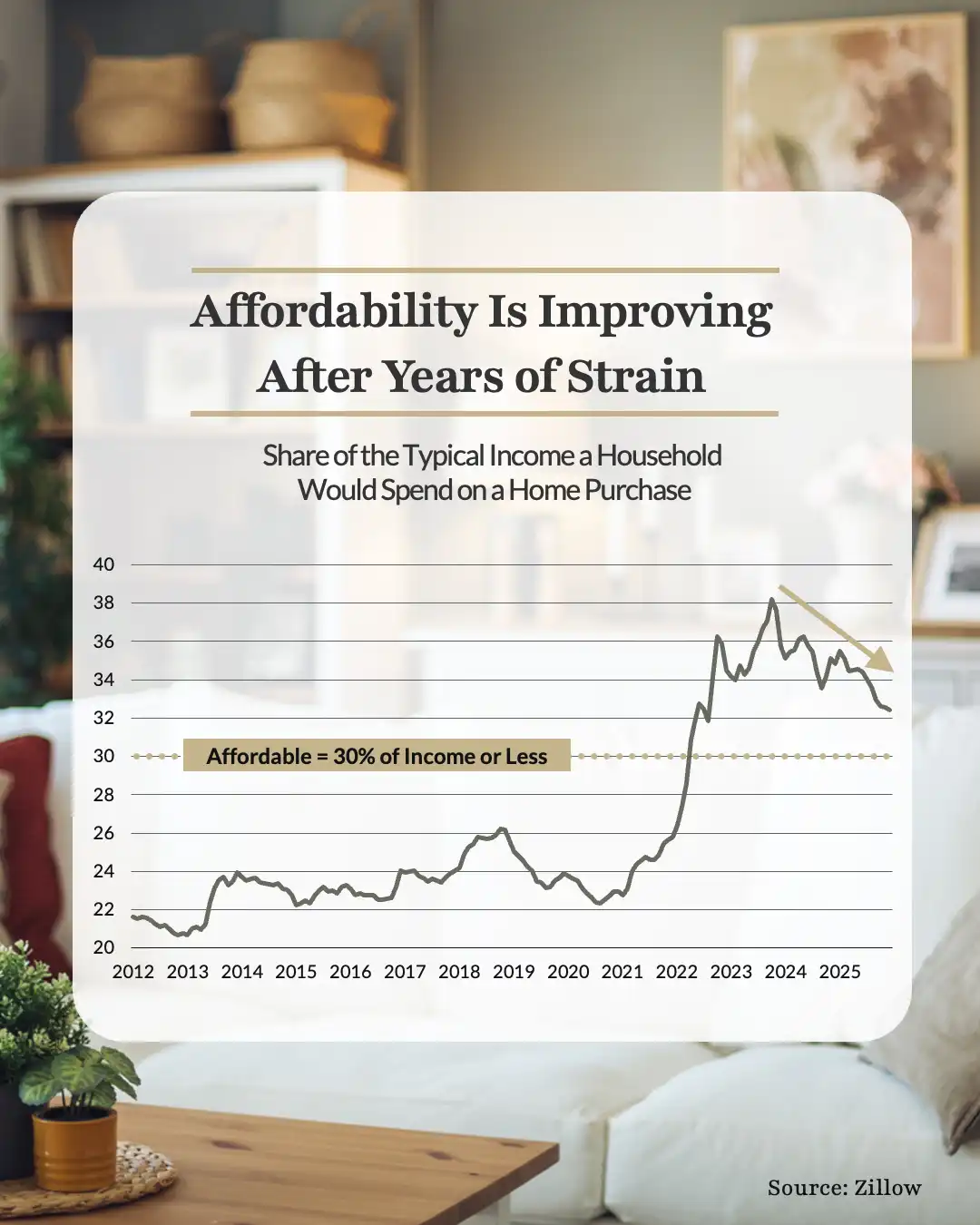

One way to measure affordability is looking at how much of your monthly income goes toward housing costs. Zillow typically considers housing affordable when it takes 30% or less of your income to cover your mortgage, taxes, insurance, and basic maintenance.

For the past few years, we were way above that mark, and honestly, it made homeownership feel impossible for a lot of people. But we’re seeing real improvement now. According to Zillow’s research, it’s taking less of a typical household’s income to buy a home than it did just a couple years ago.

We’re not back to that 30% threshold yet, so yes, affordability is still tight. But the trend? It’s headed the right way.

What’s Making the Difference?

Everyone’s been talking about mortgage rates coming down—and they have, significantly. But that’s not the only thing helping buyers right now. Here’s what’s working in your favor:

Mortgage rates have dropped to their lowest level in over three years, which means lower monthly payments. Home price growth has cooled way down. We’re not seeing prices fall nationally, but they’re climbing much more slowly than they were, which makes budgeting and planning so much easier. And here’s a big one: wages are growing faster than home prices. Mark Fleming, Chief Economist at First American, puts it perfectly: “When income growth exceeds house price growth, house-buying power improves—even if mortgage rates don’t decline meaningfully.”

None of this makes buying cheap, but it does explain why the math is starting to make sense again for buyers who felt completely priced out just a year ago. Fleming describes it well—affordability won’t snap back overnight, but we’re finally sailing in the right direction.

Where It’s Improving Fastest

Some markets are expected to hit that affordability threshold (30% of income or less) by the end of this year, according to Zillow. But you don’t have to be in one of those specific markets or wait until December to benefit. Other areas are already seeing real improvement.

That’s why talking to someone who knows the Indianapolis market matters so much. What’s happening nationally is one thing—what’s happening in downtown Indy, Meridian Kessler, Carmel, or Noblesville might be even better news.

What This Means for You

For the first time in quite a while, affordability is easing. That’s a meaningful shift, and it’s worth paying attention to.

Because this improvement isn’t happening everywhere at the same pace, understanding what’s changing here in Indianapolis is what really makes the difference. If you want to talk through how these trends are showing up in our market and what it might mean for your buying timeline, let’s connect.